If you are looking to finance a purchase, your credit score will definitely have an impact on your options, perhaps even limiting what companies will accept you if your credit score is less than ideal.

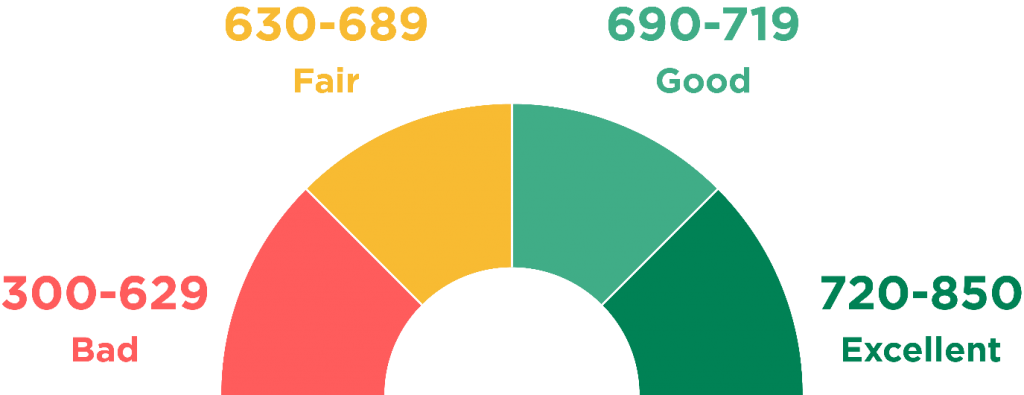

For those who are not in the know, a credit score is just a numerical variable attributed to your ability to pay recurring payments (usually on a monthly basis) in a timely manner. The number usually consists of 3 digits that goes from 300 up to 850, with a lower the number reflecting a bad score, and the higher the number reflecting a good score. Late, missing or partial payments often have a negative impact on your credit score, but there are ways to improve it.

As always, prevention is the best cure. If you feel you will not be able to make a payment on time, contact the company to avoid them being marked as late. Most companies will be more understanding and agree to a partial or delayed payment if you contact them beforehand, rather than leaving them in the dark about your current financial difficulties. It shows responsibility on your end, and they will be more sympathetic to your plight and actively work with you to make your payment for that month more manageable.

What Does This Mean for Car Financing?

As you can imagine, having a good credit rating makes gaining a favourable financing package much easier. Often most companies will accept you, and your repayments are more likely to have a lower rate of interest attached. This means it’s even easier to build on your already positive credit rating, as the payments are more manageable..

On the other hand, lower credit ratings have the exact opposite effect. Financing companies may add more interest, or even reject applications outright as your score shows less reliability with making payments. Even if the credit score is more due to unfortunate financial situations out of your control, finance businesses will merely make a payment plan based on your rating, not the reason.

But this does not mean you can never receive finance suitable to you. Financial advisors work with you, acting as a liaison with finance companies to find a repayment plan that suits you and your needs. It may require some sacrifices, such as downgrading from that beautiful sports model in favour of an A to B, but guaranteeing yourself a plan to fit your current financial situation will benefit you more in the long run, as it will be a big step in improving your credit rating, thus opening more doors to you in the future, maybe even that sports car you wanted!

How to Check Your Credit Scores

Curious to know your own? Luckily, there are a plethora of ways to check, with various websites and mobile apps offering free and simple credit checks. Experian, clear score and credit karma are just a few of the reputable sites that offer checks without having any effect on your current credit score. Your rating will be displayed as a 3-digit number, and the bigger the number, the better your credit! If your score is above 800, your credit rating is excellent, and you will be able to work with whatever finance company you desire. But if your rating is around 300, unfortunately, that is a bad credit rating, and you may struggle with getting accepted with some companies. Fortunately, you don’t have to be stuck with a negative score. There are ways you can build on your score, and raise it to greatness!

Increasing Your Credit Score

After reading through this and realizing the importance of credit for funding necessary purchases such as cars, you probably want some tips on how to increase your overall score.

The main method is by keeping up with any direct debits you have, paying the instalments in full, and making sure they are under your name. These can be things like phone contracts, utility bills, rent, mortgage and other such normal payments you would make.

Also registering your new address on the electoral roll and avoiding maxing out your credit allowance proves you are a pragmatic and sensible individual with a good sense of fiscal responsibility, and would indeed bolster your chances of a finance company helping fund your dream vehicle. And then keeping up with your car finance payments will even further your credit rating–it’s a win-win.

But even if you find your rating low and cannot seem to find a way to improve it, there is no need to panic! Aintree Garages and the Car Finance Company can still lend a helping hand with helping you secure affordable financing for the car of your dreams! We are specialists in securing car finance for those with even the lowest credit rating, liaising very closely with multiple, reputable financing companies to ensure we find the car and credit company right for you.

For further information, or to begin your car financing journey, call us now on 0151 521 4000. Visit our website https://www.aintreegarages.co.uk/ to check out our entire range of stock!