When applying for car finance, having a good credit score can really help get you a good application that will increase your chances of being accepted.

Have you ever thought about your own credit score? If you have applied previously for a loan or if you have a credit card then this is something that you’ll know about. To be able to have a loan or a credit card you have to have credit and usually it has to be good.

Although when applying for car finance your credit isn’t the only factor that can affect your car finance application, but it is a big part of it. Having a good credit score can show the car finance companies you will make the repayments on time.

But the question that is often asked is what counts as good credit score and if your credit isn’t great what can you do to make it better and improve it.

Credit score

So what is a credit score? A credit score is a three digit number that represents your ability to make repayments on your loans. It is abasically a representation of what type borrower you are and what your previous borrowing history is. If you have a good credit score, the chances are you will have a higher chance of acceptance whereas if you have a lower credit score the chances are lower but that doesn’t mean you won’t be accepted. This is where finance specialist can work closely with you to try and get you the best deal they can.

What number is a good credit score?

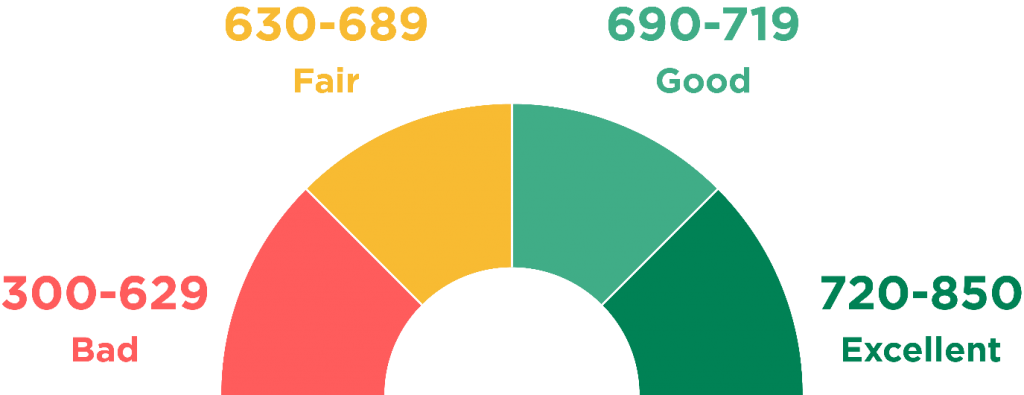

When looking at your credit score there is no pin point specific number that will guarantee you an approved loan. Credit scores usually range from 300 to 860 and where you sit on this scale will depend of what your credit score is. But usually over 580 is a fair rating, 670 and above is a good rating and if your score is 700 is classed as very good. This is different across the CRA’s so will vary from different agencies.

A CRA is a credit reference agencies such as Experian and Equifax. Each one of these agencies can calculate your credit score using information that differs in all the different agencies. Different CRA agencies have a different scale so where in one agency your score could be good whereas in another agency it could only be a fair rating so it is all dependant on the company.

So every agency has its own scale of what they class as good or fair etc. But when you are applying for car finance, your credit score isn’t the only factor that is considered. When they make the final decision they can also take into considerations such as the length of time you have lived at your current address or what your employment history is. These are all factors that can sway the decision of your car finance application decision.

Can I check my credit score?

Finding out your credit score can be really helpful. The more you know about it the better off your are. It is a good idea to regularly check it just so you know where you are at. There are a couple of CRAs that you can use to check your credit score.

There are a couple agencies you can use including Experian CreditKarma and ClearScore to name a few. All these agencies allow you to check your credit score for free and will also inform you where your credit score sits on the scale of if its good of not so good. Whilst you are checking you’re credit score you can also check over you credit report and just ensure your details are all correct and up to date.

Can I improve my credit and how?

Improving your credit is something that takes time and patience but can be done. There are a few things you can do to improve your credit score.

Things such as joining electoral roll when you change addresses, its really easy and quick and can be done online in a very short amount of time. Doing things such as ensuring all repayments are made on time, don’t max out your credit allowance. These are all small ways to help rebuild and improve your credit.

Having a bad credit score does not mean you cant be accepted for car finance though. We have in house finance specialist who will work with you to get you the best deal they can, it is not guaranteed that your application will be accepted but we have had previous success working with bad credit clients. We have a large range of cars available to suit all needs and price ranges, if you are looking for a new vehicle then give us a call and we may be able to help.

The Car Finance Companies provide you with a massive selection of used cars and vans. We are based in Liverpool, Merseyside but can deliver UK wide. Check out our stock range and give us a call on 0151 523 4000 to get started on getting that dream car today!